You can find all kinds of information about investing. Facts are, it would take you forever to read everything about investing, and more than likely, you would just come away confused. Then what are the fundamentals concerning investing that you should take the time to learn? Keep reading to find out.

Analyze the stock market for some time before deciding to purchase stocks. It’s smart to study the market before making your initial investment. If it’s possible, you should keep an eye on the movement trends over a three-year periods, using historical data for past years as you see fit. This way, you will have a better idea of exactly how the market works, and will have more chance of actually making money.

Diversify your investments, allocating your money to different types of stock investments. You do not want to put all your eggs in one basket, as the saying goes. As an example, suppose you invest all of your money into one stock only to have it tank. You wind up losing your hard-earned savings.

Compile strong stocks from a myriad of industries if you’re poising your portfolio for long-range, maximum yields. Even though the entire market averages good growth, not at all industries are constantly and simultaneously in expansion. By maintaining investment positions in various sectors, you can grab some of the growth in hot industries, regardless of whether it’s in small caps, internationals or blue chip companies. By re-balancing your portfolio, you lessen your losses in smaller sectors while taking positions in them during their next growth cycle.

Avoid thinking of stocks as generic elements; instead, think of them as a key piece of the issuing company, your own personal stake. Carefully evaluate and analyze a business when determining the value of the stocks you have invested in. This will let you think critically about which stocks to purchase.

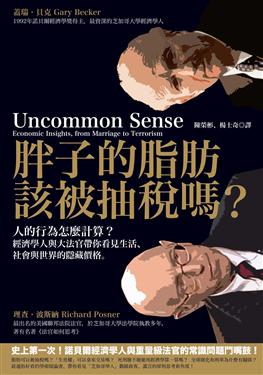

Full Service

Think of stocks as you owning part of a company. Take the time to analyze the financial statements and evaluate the strengths and weaknesses of businesses to assess the value of your stocks. This gives you the ability to really consider your options when it comes to investing.

If you want to split your time between making your own picks and a broker who offers full service, work with one who offers online options and full service. This will help you to better manage your stock portfolio. When you do this, you gain more control of your investments while still having that professional assistance.

Now you have read what you should know. You now have the basic information about why you should invest and how to do it. While it is fun during your youth to not plan too far in advance, sometimes you need to look a little further than next week. You now have some great advice in your arsenal, and you should use it to move towards a better future.